Introduction

Contents

Real estate is a diverse and vital sector encompassing the acquisition, development, and management of physical properties, land, and assets. It holds a central place in global economies, shaping the way we live, work, and invest. This industry is characterized by its multifaceted nature, with residential, commercial, industrial, and agricultural real estate segments each serving distinct purposes and markets. Residential real estate comprises homes and dwellings, while commercial real estate involves office spaces, retail centers, and more. Industrial real estate encompasses factories and warehouses, and agricultural real estate pertains to farms and rural land.

The real estate market's dynamism is driven by economic conditions, interest rates, demographic shifts, and urbanization trends, making it a reflection of broader societal changes. Investors, developers, real estate agents, and property managers all play integral roles in this ecosystem. Understanding the fundamentals of real estate is crucial whether you're a prospective homeowner, a seasoned investor, or someone interested in the profound impact this industry has on our daily lives and the global economy.

Challenges faced by the Real Estate Industry

The real estate industry faces a range of challenges that can vary by region and market conditions, but some common challenges include:

Economic Volatility: The real estate market is highly sensitive to economic conditions, including recessions, interest rate fluctuations, and inflation. Economic downturns can lead to decreased demand for properties and declining property values.

Supply and Demand Imbalances: Many regions experience imbalances between the supply of available properties and the demand from potential buyers or tenants. This can lead to price spikes and affordability issues in some areas, while others may suffer from a surplus of unsold properties.

Regulatory and Legal Complexities: Real estate transactions are subject to a wide range of regulations and legal requirements at the local, state, and national levels. Navigating these complexities can be time-consuming and costly.

Property Valuation Challenges: Accurately valuing real estate can be challenging, especially in markets with limited data or where property values are rapidly changing. Incorrect valuations can lead to financial losses for buyers, sellers, and investors.

Financing Hurdles: Access to financing is a critical factor in real estate transactions. Stringent lending standards, high interest rates, or limited access to credit can hinder property purchases and development projects.

Technology Disruption: The real estate industry is being transformed by technology, with innovations such as online listings, virtual tours, and blockchain-based property records. Traditional players may struggle to adapt to these changes.

Environmental Concerns: Climate change and environmental regulations are increasingly affecting real estate. Properties in areas prone to natural disasters, like flooding or wildfires, can become less desirable, and sustainability considerations are gaining importance.

Infrastructure and Urban Planning: Infrastructure deficiencies and urban planning issues can affect property values and accessibility. Transportation, utilities, and public services all play a role in the attractiveness of real estate locations.

Political Instability: Political instability and policy changes can create uncertainty in the real estate market. Shifts in government policies related to taxation, zoning, or development can impact property values and investment decisions.

Health and Pandemic Concerns: Events like the COVID-19 pandemic have highlighted the vulnerability of certain real estate sectors, such as commercial office space and hospitality. Remote work trends and health concerns can reshape property demand and usage patterns.

Demographic Changes: Changing demographics, including ageing populations and shifts in urbanization patterns, can influence the types of properties in demand and the locations where people choose to live and work.

Construction and Labor Costs: Rising construction and labour costs can impact the feasibility of development projects and the affordability of newly built properties.

Navigating these challenges requires adaptability, careful planning, and a thorough understanding of local market dynamics. Real estate professionals, investors, and policymakers must continually assess and respond to these challenges to ensure the long-term sustainability and success of the industry.

Role of blockchain in Real Estate Industry

Blockchain technology plays a pivotal role in reshaping the real estate industry toward a decentralized future.

Here are some of the key roles blockchain can play in achieving this transformation:

Transparent and Immutable Records: Blockchain creates a tamper-proof ledger that records all real estate transactions. This transparency ensures that property records, including ownership history, titles, and valuations, are accurate and cannot be easily manipulated. This reduces fraud, disputes, and the need for intermediaries, making the real estate market more transparent and trustworthy.

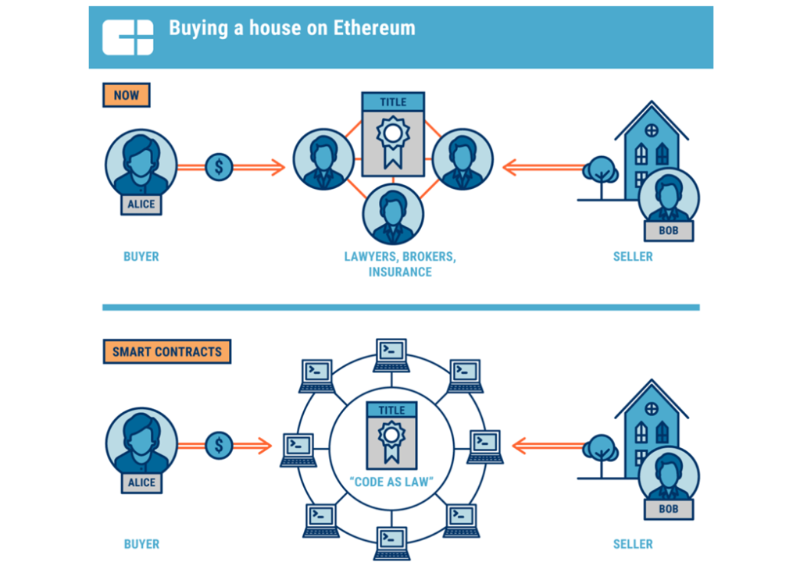

Smart Contracts for Automated Transactions: Smart contracts, self-executing agreements with predefined rules, automate various aspects of real estate transactions. They can facilitate property purchases, lease agreements, and property management. When predefined conditions are met, these contracts automatically execute, reducing the reliance on lawyers, brokers, and escrow services.

Tokenization of Real Estate Assets: Blockchain enables the fractional ownership of real estate through the creation of digital tokens representing ownership in a property. This concept, known as tokenization, allows investors to purchase and trade smaller, more affordable portions of real estate assets. It democratizes real estate investment and broadens access to property ownership. Tokenize by Chainize provides an easy to deploy solution.

Property Data Management: Blockchain can be used to securely store and share property-related data, such as inspections, maintenance records, and energy efficiency ratings. This can improve transparency for buyers and tenants and streamline property management processes.

Efficiency and Cost Reduction: Blockchain streamlines property transactions by eliminating intermediaries and redundant paperwork. This efficiency reduces transaction costs, making real estate more accessible and affordable for buyers and sellers. Additionally, it speeds up the closing process, reducing the time it takes to complete a real estate transaction.

Cross-Border Transactions: Blockchain's global nature simplifies cross-border real estate transactions. It provides a secure and standardized platform for verifying property titles and records in different jurisdictions. This can attract international investors and promote globalization in the real estate market.

Data Sharing and Collaboration: Blockchain facilitates secure data sharing among various stakeholders, including lenders, appraisers, insurers, and government agencies. This shared data can lead to more informed decision-making in real estate transactions, financing, and regulatory compliance.

Democratizing Access: Blockchain's decentralized nature reduces the concentration of power in the hands of a few intermediaries. It enables individuals to participate more actively in real estate investments and property management, promoting a more inclusive and equitable real estate ecosystem.

Dispute Resolution: In the event of disputes, blockchain can provide an immutable record of all transactions and agreements, making it easier to resolve conflicts and establish a clear chain of ownership. This can reduce the time and costs associated with legal disputes in real estate transactions.

Energy Efficiency and Sustainability: Blockchain in real estate fosters energy efficiency and sustainability by securely tracking energy consumption, validating renewable energy sources, and automating energy management through smart contracts. This technology promotes transparency and trust in sustainability efforts, ultimately reducing waste and advancing the real estate industry's commitment to a greener future.

Crowdfunding and Investment Platforms: Blockchain-based crowdfunding and investment platforms in real estate have emerged as innovative ways for individuals and institutions to invest in real estate projects. These platforms leverage technology and the principles of crowdfunding to democratize real estate investment, making it accessible to a broader range of investors.

While blockchain holds great promise for revolutionizing the real estate industry, it still faces challenges such as regulatory compliance, technological integration, and industry-wide standardization. However, as these obstacles are addressed and blockchain technology matures, it has the potential to create a more efficient, accessible, and decentralized future for the real estate market, benefiting both industry professionals and the broader population.

Conclusion

To sum up, the integration of blockchain technology into the real estate sector is paving the way for a decentralized future full of potential. By tackling major issues like fraud, inefficiency, and lack of transparency in property dealings and management, blockchain is revolutionizing an industry long burdened by convoluted procedures and intermediaries. With unchangeable property records, automated transaction smart contracts, and the emergence of tokenization, blockchain isn't just a technological advancement; it's a driving force behind democratizing real estate. This means making it accessible to a broader spectrum of participants, ranging from small investors to large corporations.

However, the journey to full-scale adoption of blockchain in real estate is not without its challenges. Regulatory frameworks need to adapt to accommodate this technology, and widespread industry adoption will require concerted efforts in standardization and integration. Nevertheless, the potential benefits are substantial, offering a future where real estate transactions are more secure, efficient, and inclusive. As the industry embraces this revolution, it positions itself for a more transparent, resilient, and adaptable future, ultimately benefiting all those who engage with the real estate market.

For more information and other Enterprise use cases, contact Chainize.